Is A Micro Payment Business Your Next Business?

At Astute Theory with our extensive expertise and knowledge, we are uniquely positioned to guide and support you in the process of creating a business idea. Our team of experienced professionals understands the intricacies of developing successful ventures and can provide valuable insights and strategies tailored to your specific needs.

A buzz word that clients have been looking for us to build software for is Micro Payment Solutions.

So what is a Micro Payment Solution?

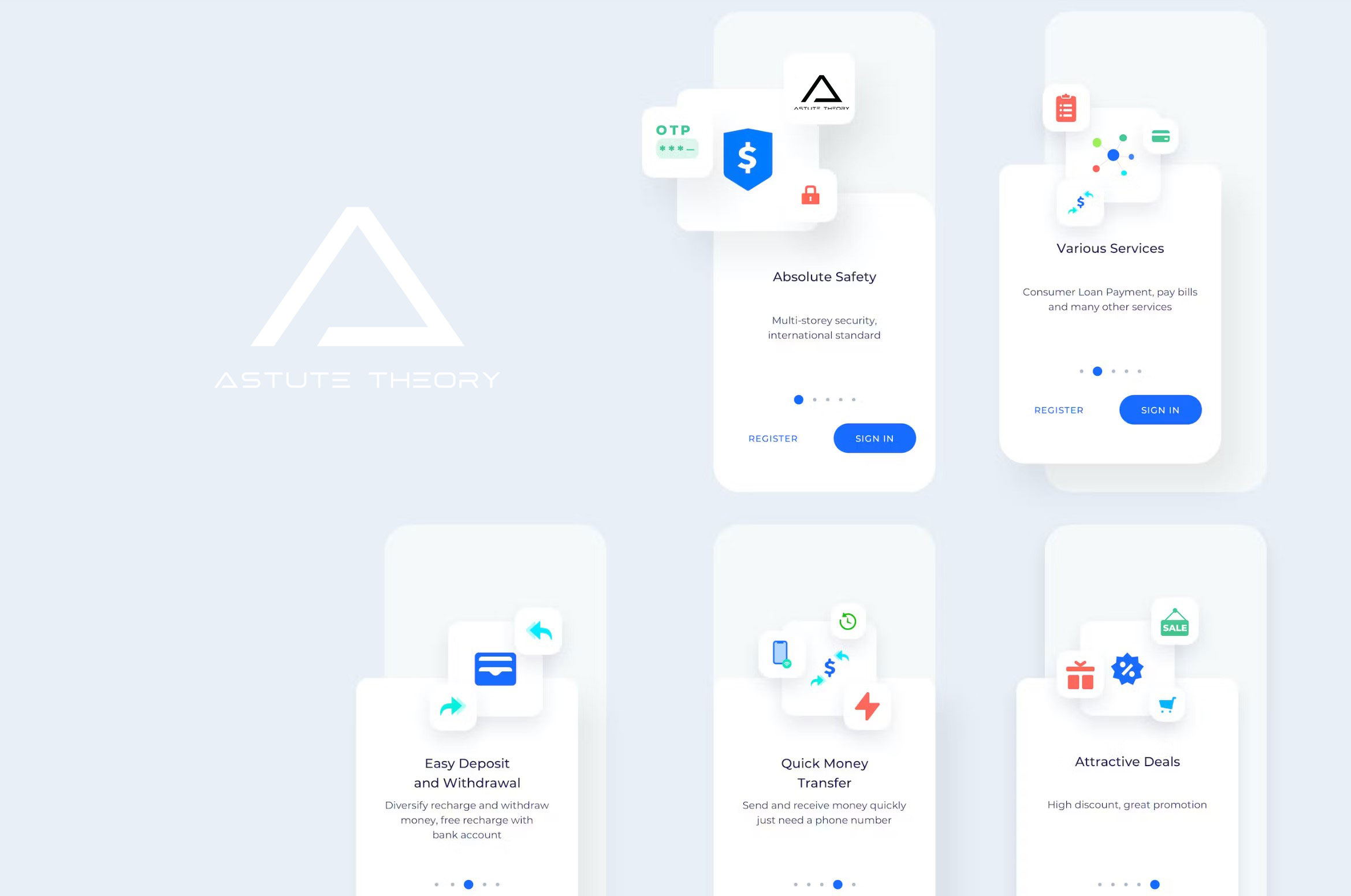

A micro payment business refers to a specialized enterprise that facilitates small financial transactions, typically involving low-value amounts. These businesses have emerged as a result of the increasing demand for quick, convenient, and affordable payment solutions for small purchases, services, or digital content in the digital era.

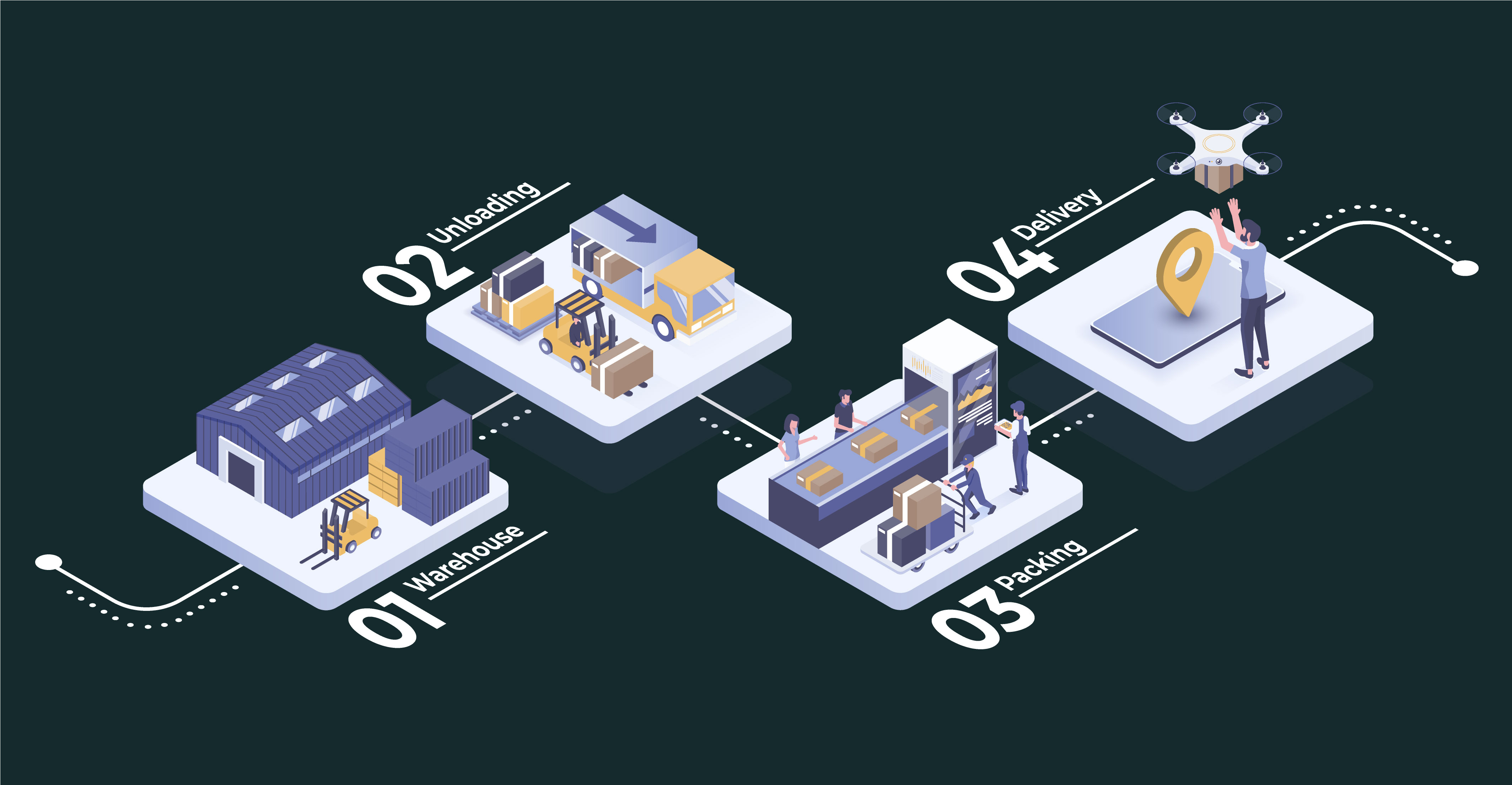

Micro payment businesses primarily operate in the online realm, leveraging the power of digital platforms, mobile apps, and e-commerce websites to enable seamless transactions. Their main objective is to provide a hassle-free and cost-effective way for users to make small payments, often in the range of a few cents to a few dollars.

The rise of micro payment businesses can be attributed to several factors. Firstly, the advent of the internet and the widespread use of smartphones have facilitated online transactions, making it easier for individuals to make small payments for various goods and services. Micro payment businesses capitalize on this trend by streamlining the payment process and reducing friction points, allowing users to make quick and efficient transactions. Some examples of businesses that are micro payment solutions are: PayPal, Patreon, Steam, and Tapjoy

Key Drivers?

Another key driver for the growth of micro payment businesses is the shift in consumer behaviour towards instant gratification. In today’s fast-paced world, consumers seek immediate access to products, services, and digital content. Micro payments offer a way to cater to this demand by breaking down larger expenses into smaller, more manageable amounts. This not only provides convenience to consumers but also opens up new revenue streams for businesses, as users are more likely to make frequent small purchases.

Micro payment businesses have found particular success in industries such as e-commerce, gaming, content streaming, digital media. In e-commerce, micro payments enable the purchase of virtual goods, in-app purchases, or add-ons, allowing users to enhance their online experience without committing to a significant upfront cost. In gaming, micro payments are commonly used for in-game purchases, unlocking additional features or acquiring virtual items. Content streaming platforms offer micro payment options for subscriptions or pay-per-view models, granting users access to premium content in exchange for small fees.

What Are The Advantages?

The advantages of micro payment businesses extend beyond the convenience and affordability they offer. These businesses have the potential to unlock new revenue streams for companies that embrace micro transactions. By reducing barriers to entry and providing frictionless payment options, micro payment businesses can attract a larger customer base, especially among price-sensitive or impulse buyers. Additionally, the incremental nature of micro payments encourages users to make repeat purchases, further enhancing customer loyalty and driving revenue growth.

However, micro payment businesses also face challenges and considerations. They must carefully select the right payment infrastructure and technology to ensure secure and reliable transactions. Compliance with legal and regulatory frameworks, such as data protection and privacy laws, is crucial to protect user information. Managing risk and fraud is another critical aspect that micro payment businesses need to address by implementing robust security measures and collaborating with payment service providers.

In conclusion, micro payment businesses have emerged as a response to the growing demand for quick, convenient, and affordable payment solutions for small transactions. By leveraging digital platforms and mobile technologies, these businesses enable seamless micro transactions and unlock new revenue opportunities across various industries. As consumer behaviour continues to evolve and the digital landscape expands, micro payment businesses are poised to play an increasingly vital role in facilitating the seamless exchange of small-value transactions.

No matter if your question relates to this topic or about another one of our services, we offer a free initial 1 hour consultation to see how we can assist.